Building a secure financial future requires more than just earning money. It requires planning, strategy, and understanding all the tools available to you. In this comprehensive guide, we’ll show you how to create a financial plan that leverages government benefits, manages debt, and positions you for long-term success.

## The Foundation: Understanding Your Financial Situation

Before you can plan for the future, you need to understand where you are today.

**Calculate Your Net Worth:** Add up all your assets (home, savings, investments) and subtract your liabilities (mortgage, loans, credit card debt). This gives you your net worth.

**Track Your Income:** Know exactly how much money comes in each month from all sources, including government benefits.

**Analyze Your Expenses:** Track where your money goes. Categorize expenses into essential (housing, food, utilities) and discretionary (entertainment, dining out).

**Identify Your Debt:** List all debts with interest rates and minimum payments. High-interest debt should be a priority.

**Assess Your Goals:** What do you want to achieve? Retirement? Home ownership? Education? Clear goals guide your planning.

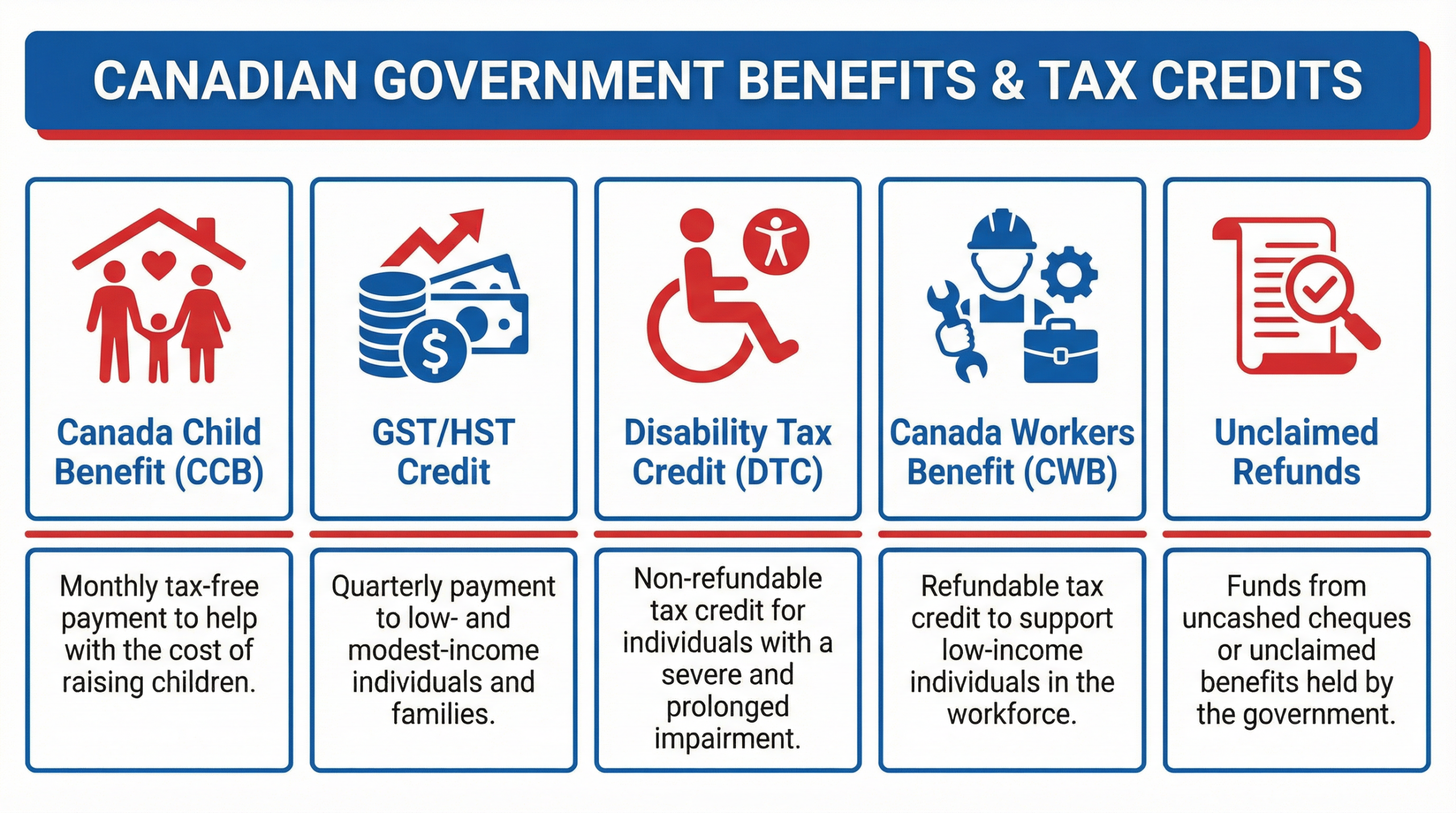

## Maximizing Government Benefits

Government benefits are a crucial part of financial planning. Many Canadians leave money on the table by not understanding or claiming all available benefits.

**Research All Available Benefits:** Don’t assume you don’t qualify for something. Check what benefits you might be eligible for.

**File Your Tax Return Annually:** This is how you claim most government benefits. Never skip filing, even if you think you don’t owe taxes.

**Keep Your Information Updated:** If your income, family situation, or address changes, update CRA immediately. This ensures you receive all benefits you’re entitled to.

**Plan Around Benefit Payments:** Know when benefits are paid and factor them into your budget. This helps with cash flow planning.

**Understand Income Limits:** Some benefits phase out as income increases. Plan your income strategically to maximize benefits.

## Debt Management Strategies

Debt can be a major obstacle to financial security. Here are strategies to manage and eliminate it:

### Understanding Your Debt

Different types of debt have different implications:

**High-Interest Debt:** Credit cards typically charge 18-21% interest. This should be your priority to eliminate.

**Medium-Interest Debt:** Personal loans typically charge 8-15% interest.

**Low-Interest Debt:** Mortgages typically charge 3-7% interest. This is generally acceptable debt.

**Student Loans:** Interest rates vary, but repayment can be deferred if you’re in financial hardship.

### Debt Consolidation Options

If you have multiple debts, consolidation might help:

**Personal Loans:** A personal loan can consolidate multiple debts into one payment with a lower interest rate.

**Balance Transfer Credit Cards:** Some credit cards offer 0% interest for a limited period if you transfer balances.

**Home Equity Loans:** If you own a home, you might access lower-interest credit using your home equity.

**Debt Consolidation Services:** Professional services can negotiate with creditors on your behalf.

The key is to reduce your overall interest costs and simplify your payments.

### Creating a Debt Payoff Plan

Once you understand your debt, create a plan:

**List All Debts:** Include creditor, balance, interest rate, and minimum payment.

**Choose a Strategy:** Either pay off highest-interest debt first (avalanche method) or smallest balance first (snowball method).

**Make Extra Payments:** Any extra money should go toward debt, not discretionary spending.

**Avoid New Debt:** While paying off existing debt, avoid taking on new debt.

**Track Progress:** Monitor your progress monthly. Seeing progress motivates continued effort.

## Building an Emergency Fund

An emergency fund is essential for financial security. It protects you when unexpected expenses arise.

**How Much to Save:** Aim for 3-6 months of living expenses. Start with $1,000 and build from there.

**Where to Keep It:** Use a high-interest savings account that’s separate from your regular checking account.

**Automatic Transfers:** Set up automatic transfers to your emergency fund each payday.

**Don’t Touch It:** Only use this fund for true emergencies, not for wants or impulses.

**Rebuild After Use:** If you use your emergency fund, rebuild it as soon as possible.

## Investing for the Future

Once you’ve paid off high-interest debt and built an emergency fund, consider investing:

**Registered Retirement Savings Plan (RRSP):** Contributions are tax-deductible, and growth is tax-deferred. This is excellent for retirement planning.

**Tax-Free Savings Account (TFSA):** Contributions are not tax-deductible, but growth is tax-free and withdrawals are tax-free.

**Non-Registered Investments:** Once you’ve maxed out RRSP and TFSA, consider non-registered investments.

**Diversification:** Don’t put all your money in one investment. Spread risk across different asset types.

**Regular Contributions:** Invest consistently, even if amounts are small. Time in the market beats timing the market.

## Retirement Planning

Retirement planning should start early. The earlier you start, the more time your money has to grow.

**Estimate Your Needs:** How much will you need annually in retirement? Consider inflation.

**Calculate CPP Benefits:** Understand how much you’ll receive from Canada Pension Plan.

**Plan for OAS:** Old Age Security provides additional income starting at 65.

**Maximize RRSP Contributions:** Take advantage of tax deductions and employer matching if available.

**Consider Deferring CPP:** Deferring CPP from 60 to 70 increases your benefit significantly.

**Plan for Healthcare:** Healthcare costs increase with age. Budget for this.

## Insurance Considerations

Insurance protects your financial plan from unexpected events:

**Life Insurance:** If others depend on your income, life insurance is essential.

**Disability Insurance:** If you can’t work, disability insurance replaces lost income.

**Home and Auto Insurance:** These are typically required and protect major assets.

**Critical Illness Insurance:** This covers you if you develop a serious illness.

**Long-Term Care Insurance:** This covers costs of care if you need assistance later in life.

## Creating Your Financial Plan

Now that you understand the components, create your plan:

**Step 1: Set Goals:** Define specific, measurable financial goals with timelines.

**Step 2: Assess Current Situation:** Understand your net worth, income, expenses, and debt.

**Step 3: Claim All Benefits:** Ensure you’re receiving all government benefits you qualify for.

**Step 4: Eliminate High-Interest Debt:** Make this your priority.

**Step 5: Build Emergency Fund:** Save 3-6 months of expenses.

**Step 6: Invest for Future:** Once debt is managed, invest for retirement and other goals.

**Step 7: Review and Adjust:** Review your plan annually and adjust as needed.

## Related Resources

Now that you understand financial planning, explore these related topics:

– Return to the [main guide on unclaimed benefits](https://suareceitadiaria.com.br/canadian-government-benefits/) to ensure you’re claiming everything

– Learn [how to check your benefits online](https://suareceitadiaria.com.br/check-canadian-benefits-online/)

– Discover [tax credits and refunds](https://suareceitadiaria.com.br/canadian-tax-credits-refunds/) to maximize your returns

– Review [eligibility requirements](https://suareceitadiaria.com.br/canadian-benefits-eligibility/) for specific benefits

## Frequently Asked Questions

**Q: Is it ever too late to start financial planning?**

A: No. Start where you are. Even starting late is better than never starting.

**Q: Should I pay off debt or invest?**

A: Generally, pay off high-interest debt first. Then invest. The interest you avoid on debt often exceeds investment returns.

**Q: How often should I review my plan?**

A: At least annually, or whenever major life changes occur (marriage, job change, children).

**Q: What if I can’t save much each month?**

A: Start small. Even $25 per month adds up over time. Consistency matters more than amount.

**Q: Should I get professional help?**

A: For complex situations, yes. A financial advisor can provide personalized guidance.

## Conclusion: Your Financial Future Starts Today

Building a secure financial future is achievable if you have a plan. Start by maximizing government benefits, managing debt, and investing in your future. The sooner you start, the more time your money has to work for you.

Remember: financial security doesn’t happen by accident. It’s the result of planning, discipline, and consistent action. Start today, and your future self will thank you.

—

## Legal Disclaimer

This content is provided for informational and educational purposes only. It does not constitute financial, legal, or professional advice. Financial situations are unique and complex. The SRF (Sua Receita Financeira) has no affiliation with financial institutions or government agencies. Always consult with qualified financial and legal professionals before making major financial decisions.

—

**Author:** Sarah Mitchell

**Specialist in:** Financial Planning and Government Benefits

**Published:** 2026