Eligibility Requirements for Canadian Government Benefits

Not everyone qualifies for every government benefit. Understanding the eligibility requirements is crucial before you apply. In this guide, we’ll break down the specific requirements for major Canadian benefits so you know exactly where you stand.

Basic Eligibility Criteria

Before diving into specific benefits, there are some general requirements that apply to most programs:

Canadian Citizenship or Residency: You must be a Canadian citizen or a permanent resident. Some benefits may have different requirements.

Age Requirements: Different benefits have different age requirements. Some are for children, others for working-age adults, and some for seniors.

Income Limits: Many benefits have income thresholds. If your income exceeds the limit, you might not qualify.

Residency Requirements: You must reside in Canada and maintain your Canadian address.

Tax Filing: You must file your tax return to receive most benefits.

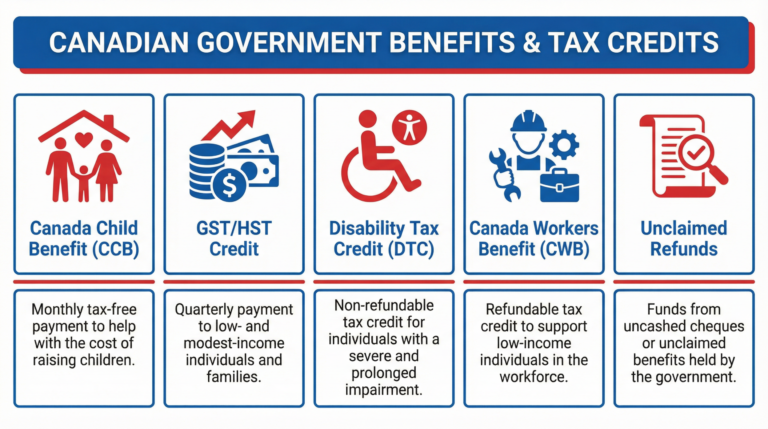

Major Benefits and Their Eligibility Requirements

Canada Child Benefit (CCB)

Who Qualifies:

– Parents or guardians of dependent children under 18

– Canadian citizens or permanent residents

– Residents of Canada for tax purposes

Income Limits:

– Full benefit available if family net income is under $35,000

– Benefit phases out as income increases

– No benefit if family income exceeds approximately $173,000

Required Documents:

– Social Insurance Number

– Proof of custody of children

– Recent tax returns

Application Process:

– Automatically calculated when you file your tax return

– No separate application needed

Goods and Services Tax Credit (GST/HST Credit)

Who Qualifies:

– Canadian residents

– Individuals aged 19 or older (or married/common-law partners)

– Those with low to moderate income

Income Limits:

– Full credit available if net income is under $38,000

– Credit decreases as income increases

– No credit if income exceeds approximately $50,000

Required Documents:

– Social Insurance Number

– Recent tax return

– Proof of Canadian residency

Application Process:

– Automatically calculated when you file your tax return

– Payments made quarterly

Disability Tax Credit (DTC)

Who Qualifies:

– Individuals with severe and prolonged disabilities

– Those whose disability has lasted or is expected to last at least 12 months

– Those whose disability markedly restricts daily living activities

Medical Requirements:

– A medical professional must certify the disability

– Disability must be severe and prolonged

– Must significantly impact ability to perform daily activities

Required Documents:

– Form T2201 (completed by medical professional)

– Medical reports and documentation

– Proof of Canadian residency

Application Process:

– Submit Form T2201 to CRA

– Medical professional must complete the form

– CRA reviews and makes a decision

– Process takes 4-6 months

Canada Pension Plan (CPP)

Who Qualifies:

– Individuals who have contributed to CPP through employment

– Canadian citizens or permanent residents

– Those aged 60 or older (earliest age for retirement benefits)

Contribution Requirements:

– Must have made contributions to CPP for at least one year

– Benefit amount depends on contribution history

– More contributions = higher benefit

Required Documents:

– Social Insurance Number

– Proof of Canadian residency

– Employment history

Application Process:

– Apply online through Service Canada

– Can apply up to 4 months before desired start date

– Approval typically takes 4-6 weeks

Old Age Security (OAS)

Who Qualifies:

– Canadian citizens aged 65 or older

– Permanent residents aged 65 or older (with specific residency requirements)

– Those who have lived in Canada for at least 10 years after age 18

Residency Requirements:

– Must have lived in Canada for at least 10 years after age 18

– Must reside in Canada when benefits begin

– Can receive benefits while living outside Canada if eligibility criteria are met

Income Limits:

– Full benefit available if net income is under approximately $90,000

– Benefit clawed back if income exceeds threshold

– No benefit if income exceeds approximately $146,000

Required Documents:

– Social Insurance Number

– Proof of Canadian citizenship or permanent residency

– Proof of age

– Proof of Canadian residency

Application Process:

– Automatically enrolled if eligible

– Can apply online or by mail

– Approval typically takes 4-6 weeks

Income Limits and Thresholds

Income limits are crucial for many benefits. Here’s a quick reference:

| Benefit | Income Threshold | Phase-Out Range |

|———|——————|—————–|

| CCB | $35,000 | $35,000-$173,000 |

| GST/HST Credit | $38,000 | $38,000-$50,000 |

| OAS | $90,000 | $90,000-$146,000 |

| GIS | $20,000 | Varies by province |

*Note: These are approximate 2026 figures and may change annually.*

Special Circumstances

Newcomers to Canada

If you’re new to Canada, you might have different eligibility requirements:

– You must be a permanent resident or Canadian citizen

– You must have a Social Insurance Number

– You must file a tax return

– Some benefits require a minimum residency period

Self-Employed Individuals

If you’re self-employed:

– You can claim the same benefits as employees

– You must file your tax return annually

– You must report all income

– You can claim business expenses as deductions

Students

If you’re a student:

– You might qualify for student loans or grants (provincial programs)

– You can claim tuition credits

– Your income might affect family benefits

– You might qualify for the Canada Training Credit

Seniors

If you’re a senior:

– You qualify for OAS at 65

– You might qualify for GIS if income is low

– You can defer CPP for higher benefits later

– You might qualify for provincial seniors’ benefits

How to Verify Your Eligibility

Online Tools

The CRA website offers tools to help you determine eligibility:

– Benefit finder tools

– Income calculator

– Eligibility checker

Contact CRA

You can contact the Canada Revenue Agency directly:

– Phone: 1-800-959-5525

– Online: CRA website

– In person: Local CRA office

Professional Help

Consider consulting:

– A tax accountant

– A financial advisor

– A community organization that helps with benefits

Common Eligibility Mistakes

Not Filing Your Tax Return: You must file to receive most benefits.

Providing Incorrect Information: Always ensure your information is accurate and up-to-date.

Not Reporting Income Changes: If your income changes, update CRA immediately.

Missing Deadlines: Apply before deadlines to avoid missing benefits.

Not Keeping Records: Keep documentation to prove eligibility if questioned.

Exploring Related Information

Now that you understand eligibility, explore these related topics:

– Return to the [main guide on unclaimed benefits](https://suareceitadiaria.com.br/canadian-government-benefits/) for broader context

– Learn [how to check your benefits online](https://suareceitadiaria.com.br/check-canadian-benefits-online/)

– Discover [tax credits and refunds](https://suareceitadiaria.com.br/canadian-tax-credits-refunds/) you might qualify for

– Read our [financial planning guide](https://suareceitadiaria.com.br/canadian-financial-planning/) for comprehensive strategies

Frequently Asked Questions

Q: Can I qualify for multiple benefits at once?

A: Yes. Many people qualify for and receive multiple benefits simultaneously.

Q: What if my eligibility changes?

A: You must notify CRA immediately. Changes in income, family situation, or residency affect eligibility.

Q: Can I appeal if I’m denied a benefit?

A: Yes. You can file a Notice of Objection within 90 days of receiving the decision.

Q: How often do I need to reapply?

A: Most benefits are renewed automatically if you file your tax return annually.

Q: What if I live outside Canada?

A: Some benefits can be received while living outside Canada, but requirements vary.

Conclusion: Know Your Rights

Understanding eligibility requirements ensures you don’t miss benefits you’re entitled to. Take time to review your situation against these requirements. If you’re unsure, contact CRA or consult a professional.

Your eligibility might be better than you think. Don’t assume you don’t qualify – verify it.

—

Legal Disclaimer

This content is provided for informational and educational purposes only. Eligibility requirements can change and may vary based on individual circumstances. The SRF (Sua Receita Financeira) has no affiliation with government agencies. Always consult official CRA resources or a qualified professional for accurate, up-to-date information about your specific eligibility.

—

Author: Sarah Mitchell

Specialist in: Financial Planning and Government Benefits

Published: 2026