Canadian Tax Credits and Refunds 2026: Maximize Your Returns

Tax season doesn’t have to be stressful. If you understand Canadian tax credits and refunds, you can significantly increase the money you get back. In this guide, we’ll explain the major tax credits available, how they work, and how to claim them to maximize your returns.

What Are Tax Credits?

A tax credit is an amount that reduces the tax you owe to the government. Unlike deductions, which reduce your taxable income, credits directly reduce your tax bill. This makes them incredibly valuable.

Example: If you owe $2,000 in taxes and you have a $500 tax credit, your final tax bill becomes $1,500.

Types of Tax Credits Available

Federal Tax Credits

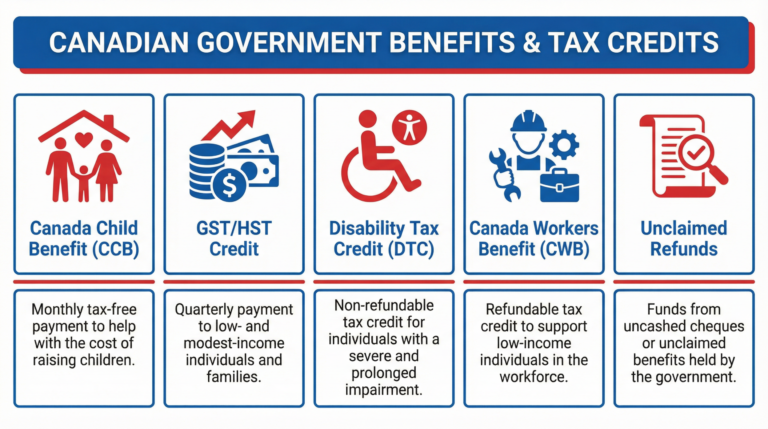

The Canadian government offers numerous federal tax credits:

Canada Child Benefit (CCB): Monthly payments for families with dependent children. The amount depends on family income and the number of children.

Goods and Services Tax Credit (GST/HST Credit): Quarterly payments for low-income individuals and families to offset the GST/HST they pay on purchases.

Disability Tax Credit (DTC): A significant credit for individuals with severe and prolonged disabilities. This can be carried forward for many years.

Earned Income Tax Credit (EITC): Additional support for working individuals with lower incomes.

Caregiver Amount: If you care for a dependent family member, you might qualify for this credit.

Adoption Expenses: If you’ve adopted a child, you can claim adoption-related expenses.

Provincial Tax Credits

Each province offers its own tax credits. These vary significantly, so it’s important to check your specific province’s offerings. Some examples include:

– Ontario: Ontario Sales Tax Credit, Ontario Energy and Property Tax Credit

– British Columbia: BC Earned Income Tax Credit, BC Low Income Family Tax Credit

– Alberta: Alberta Family Employment Tax Credit

– Quebec: Various credits specific to Quebec residents

Major Tax Credits Explained

Canada Child Benefit (CCB)

Who Qualifies: Families with dependent children under 18.

How Much: Up to $6,997 per child annually (2026 rates), depending on family income.

How to Claim: Automatically calculated if you file your tax return. You don’t need to apply separately.

Payment Schedule: Paid monthly, usually on the 20th of each month.

Income Limits: Benefits phase out as family income increases above $35,000.

Goods and Services Tax Credit (GST/HST Credit)

Who Qualifies: Canadian residents with low to moderate income.

How Much: Up to $1,000+ annually, depending on income and family situation.

How to Claim: Automatically calculated when you file your tax return.

Payment Schedule: Paid quarterly in July, October, January, and April.

Income Limits: The credit decreases as income increases above $38,000.

Disability Tax Credit (DTC)

Who Qualifies: Individuals with severe and prolonged disabilities.

How Much: The credit itself reduces tax, but it can also allow you to carry forward unused amounts for up to 10 years.

How to Claim: You must apply using Form T2201. A medical professional must certify your disability.

Approval Time: Applications can take 4-6 months to process.

Transferability: Unused credits can be transferred to a spouse or parent.

How to Claim Tax Credits

Step 1: File Your Tax Return

You must file your tax return to claim credits. Even if you don’t owe taxes, filing allows you to receive credits you’re entitled to.

Step 2: Gather Required Documents

Collect documents supporting your claims:

– Receipts for medical expenses

– Proof of childcare costs

– Adoption documents

– Disability certification

Step 3: Complete the Appropriate Forms

Different credits require different forms. The main ones are:

– Schedule 1 (for federal credits)

– Provincial tax forms

– Form T2201 (for Disability Tax Credit)

Step 4: Submit Your Return

File your return before the deadline (usually June 15). File electronically for faster processing.

Step 5: Keep Records

Keep all supporting documents for at least 6 years in case of an audit.

Common Mistakes to Avoid

Not Filing at All: If you don’t file, you won’t receive credits you’re entitled to.

Missing Deadlines: File before the deadline to avoid penalties and interest.

Incorrect Information: Double-check all information before submitting.

Not Claiming All Eligible Credits: Review all available credits to ensure you’re not missing any.

Forgetting to Update Information: If your situation changes (marriage, children, income), update your information with CRA.

Maximizing Your Tax Return

Strategy 1: Claim All Eligible Credits

Review all available credits and claim every one you qualify for. Many people miss credits simply because they don’t know about them.

Strategy 2: Optimize Your Income Splitting

If you’re married or in a common-law relationship, consider income splitting strategies to maximize credits.

Strategy 3: Time Major Expenses

If possible, time major expenses (like medical costs) to maximize deductions and credits.

Strategy 4: Keep Detailed Records

Maintain excellent records of all expenses and income. This makes claiming credits easier and protects you in case of an audit.

Strategy 5: Consult a Professional

For complex situations, consider consulting a tax accountant or financial advisor.

Planning for Financial Success

Understanding tax credits is just one part of financial planning. You should also consider:

Debt Management: If you have high-interest debt, consider consolidation options to reduce interest costs.

Personal Loans: Sometimes a personal loan for debt consolidation can save you money on interest.

Budgeting: Use your tax refund wisely. Consider saving it rather than spending it immediately.

Investment: If you have extra money, consider investing it for long-term growth.

Exploring Related Resources

Now that you understand tax credits, explore these related topics:

– Return to the [main guide on unclaimed benefits](https://suareceitadiaria.com.br/canadian-government-benefits/) for broader context

– Learn [how to check your benefits online](https://suareceitadiaria.com.br/check-canadian-benefits-online/) to see what you qualify for

– Review [eligibility requirements](https://suareceitadiaria.com.br/canadian-benefits-eligibility/) for specific benefits

– Read our [financial planning guide](https://suareceitadiaria.com.br/canadian-financial-planning/) for comprehensive financial strategies

Frequently Asked Questions

Q: When should I file my tax return?

A: The deadline is usually June 15. Filing earlier means you receive refunds faster.

Q: Can I claim credits for previous years?

A: Yes. You can file amended returns for previous years if you missed credits.

Q: What if I disagree with the CRA’s decision?

A: You can file a Notice of Objection within 90 days of receiving the decision.

Q: How long does it take to receive my refund?

A: Most refunds are processed within 2-4 weeks if you file electronically.

Q: Can I claim credits if I’m self-employed?

A: Yes. Self-employed individuals can claim the same credits as employees.

Conclusion: Maximize Your Returns

Tax credits represent money the government is offering to help you. Don’t leave this money on the table. Take time to understand what credits you qualify for and claim them all.

By maximizing your tax credits, you can significantly increase your refund and improve your financial situation. Start planning today for a better financial future.

—

Legal Disclaimer

This content is provided for informational and educational purposes only. It does not constitute financial, legal, or professional advice. Tax laws are complex and change frequently. The SRF (Sua Receita Financeira) has no affiliation with government agencies. Always consult official CRA resources or a qualified tax professional for accurate, up-to-date information.

—

Author: Sarah Mitchell

Specialist in: Financial Planning and Government Benefits

Published: 2026